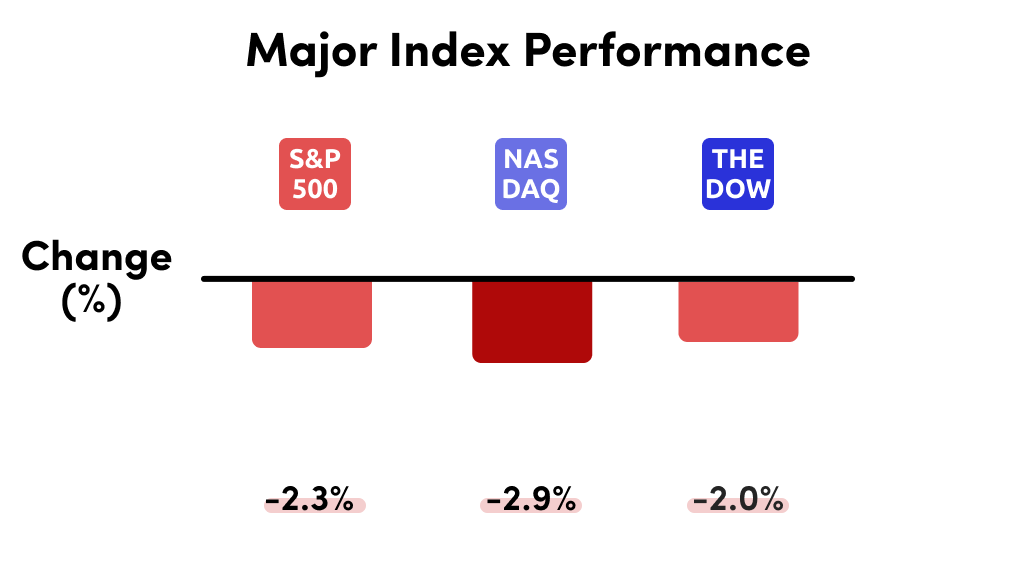

This week, the Markets continued to struggle as two economic reports signaled that inflation has become entrenched and will be harder to dispel than initially thought. During the week, all major indexes were down.

The S&P 500 lost -2.34%

The Nasdaq dropped by -2.97%

The DOW closed lower by -2.08%

The Russell fell by -2.47%

View this Week’s Gainers and Losers in the App

Weekly Recap

The S&P 500 has fallen each of the last seven weeks, the longest stretch in over a decade. Namely, the two reports that gave investors pause over inflation were the Consumer Price Index (CPI) and Producer Price Index (PPI) reports.

CPI, which tracks prices for a basket of goods for urban consumers, showed that prices are still rising month-to-month, mainly driven by food and travel costs. PPI, which tracks prices for wholesalers, also rose, indicating that prices for businesses grew more than 10% from a year ago and that those price increases will be passed on to consumers.

As inflation becomes more entrenched without an apparent release valve, Wall Street has become increasingly worried that inflation will be hard to bring down without more aggressive policy from the Federal Reserve.

However, if the Federal Reserve is too aggressive, it could lead to a "hard landing" for the US economy and lead to a recession. Stocks moved lower as investors anticipated that the US could see a pullback leading to slowing or even negative growth.

But a strong rally on Friday could give investors hope that the Market is oversold and could bottom out. Separate from the stock market, the cryptocurrency market also had a dreadful week due to the collapse of the Terra Stablecoin.

Crypto faces a crisis due to the collapse of Terra

Despite what many skeptics may believe, the cryptocurrency market and the stock market are very similar in that both rely on a foundation of trust. And the cryptocurrency market is facing a crisis of faith right now that is causing some to question if this past week could be Crypto's Lehman Brother's moment.

In case you missed it, here's a brief rundown on how the meltdown of the Terra Stablecoin (UST) has been roiling the crypto-verse this past week.

In the cryptocurrency market, so-called "stablecoins" are a fundamental type of coin which attempt to track the value of the US dollar 1 coin-to-1 dollar. Why?

Famous cryptocurrencies like Bitcoin are inherently volatile, changing dollar value with every trade. As one can imagine, it can be hard to transact commerce when the value of a coin is constantly changing value.

But, if a cryptocurrency investor wants to cash out of an investment or send a fixed value to another person, they can convert their Bitcoin into a stablecoin instead of exchanging it for the US dollar.

Investors do this because selling a cryptocurrency for dollars is a taxable event in the US. But converting a cryptocurrency into a stablecoin is not. Thus stablecoins allow crypto investors to hold their crypto assets at a fixed value and convert them back into other currencies without triggering a tax bill.

Usually, stablecoins are collateralized with assets to maintain their 1-to-1 pegged value to the dollar. However, the Terra stablecoin (UST) is not. Instead of collateral, UST uses a complicated algorithm and a companion coin called Luna to maintain its peg.

We won't get into the details, but the Terra protocol (the organization that supports UST) incentivizes investors to hold the stablecoin by offering high yields, such as 19%, in the decentralized finance (DeFi) lending market. And since 2019, it worked—until last weekend, when UST "de-pegged" or lost its 1-to-1 ratio to the dollar.

While the intent is still unknown, $2 billion worth of UST was withdrawn last weekend, triggering UST to lose its peg, initially falling 0.91 cents on the dollar. However, as investors feared that their investment in UST was losing value, a wild panic caused a massive sell-off in Terra over the past week, causing it to drop even more.

Terra has had a wild week as it de-pegged from the dollar

Since last weekend, UST's conversion ratio has moved wildly up and down and is currently at around $0.20 to the dollar. Some $40 billion of value in UST's companion coin Luna was wiped out throughout this process. And the panic also dragged down other cryptocurrencies.

Over 24 hours from Wednesday to Thursday, the total market cap of all cryptocurrencies fell over $200 billion, as coins from Ethereum to Bitcoin fell due to growing fear of contagion.

While the crypto market has since somewhat stabilized from the collapse of UST, daily volatility remains as crypto holders wonder if UST can regain its 1-to-1 peg.

Why does this matter?

Cryptocurrencies are largely unregulated but represent a significant store of global wealth, with the total market cap of all coins reaching nearly $3 trillion in 2021. However, this value has fallen to around $1.2 trillion in 2022, as crypto goes through a "winter."

Crypto’s Market Cap has more than halved since November

The collapse of UST has led some government officials to suggest that cryptocurrencies should be more heavily regulated. One proposal would be for stablecoins to be required to be collateralized.

Throughout 2021, crypto enthusiasts had flaunted that bitcoin was similar to gold in that it was a store of value, even when stocks were down. Crypto exchanges flooded tv advertising spots, with celebrities daring retail investors to be bold and buy crypto.

But this hasn't worked so well in 2022. Since the start of the year, Bitcoin has fallen 38% from $47,000 to $29,000, far outpacing the 25% drop in the NASDAQ Composite.

Over 50% of retail investors in crypto have now lost money, causing them to lose interest in the asset. Publicly-listed Brokerages like Coinbase and Robinhood have been on the losing end of the diminishing interest.

Like stocks, the rise of the crypto market was primarily driven by an influx of cheap money throughout the Pandemic. But as the Federal Reserve tightens credit and interest rates rise, monetary policy has had an amplified effect on crypto as it has had on stocks.

Crypto may not be ready for Institutional primetime.

Institutional investors are traditionally required to trade only in publicly traded securities. But due to the increased interest in cryptocurrency, many fund managers swarmed to create crypto and blockchain-related ETFs. The first one, BITO, which focuses on Bitcoin futures, launched last October.

Since the beginning of 2022, the Securities and Exchange Commission approved some 17 other crypto-related ETFs, which have attracted billions of dollars of investor funds. Institutional investors now generate the majority of trading volume for Bitcoin.

However, many of these ETFs have flopped as they have underperformed the market. And the collapse of Terra will cause institutional investors to become increasingly careful when participating in the crypto market.

Though it may still be early days, the underwhelming performances of crypto ETFs have caused investors to sour on the industry for the time being. While 80% of institutional investors are bullish on crypto, it may take a while for them to warm again on the sector. But expect demand to ebb and flow like for any trendy asset.

Further Reading

Bloomberg: Terra $45 Billion Face Plant Creates Crowd of Crypto Losers