The Market swung from a gain to a loss as investors digested the latest inflation numbers.

The S&P 500 fell -0.34%

The NASDAQ fell -0.30%

The DOW fell -0.26%

The Russell 2000 gained +0.39%

Stocks initially reacted positively to today's inflation numbers, reasoning that lower than expected core inflation could be a sign that inflation peaked. But, stocks dropped into a loss in afternoon trading as investors are concerned that inflation is still very high and the Fed might be forced to hike rates faster than expected.

Here are today's stories:

1. Inflation is Surging But Investors See Silver Lining

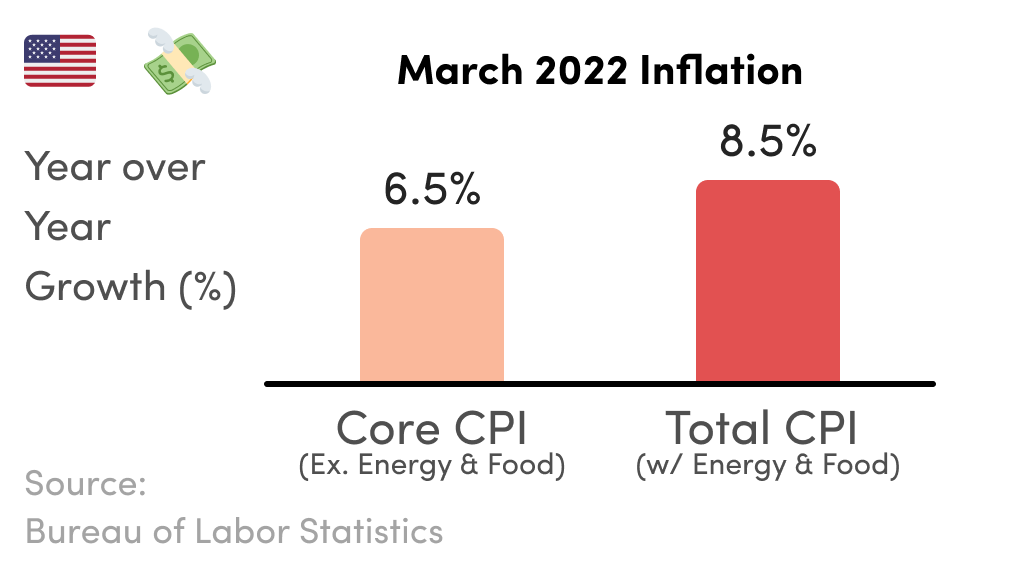

As measured by the Consumer Price Index (CPI), inflation surged to a four-decade high of 8.5% in March versus last year, driven by skyrocketing energy and food costs, supply constraints, and strong consumer demand.

Core inflation (excluding food and energy) was up 6.5%, which, while still high, was lower than economists expected. Stocks and bonds took the half glass full approach and were only down slightly. Investors are combing through consumer data and are starting to see signs that the pace of inflation could be slowing.

Many analysts believe that inflation will peak in March. The monthly increase in core inflation was only 0.3% from February to March and was lower than the 0.5% increase from January to February.

Why does this matter?

This level of high inflation can cause a consumer-led recession. If you have noticed the price at the pump and at the supermarkets have gone up a lot over the past year, you aren't the only one. Lower and middle-income households are already having to make choices about what types of food they can afford to buy or what activities they can do with their families.

The Fed has to thread a very thin needle with a very blunt tool here. If they raise rates too much to curb inflation, it could lead to a recession. But if they don't do anything about it, consumers could start pulling back on spending as they can no longer afford to buy, causing economic pain and a recession. Let’s hope that their aim is good!

2. Summer Vacation is About to Get Expensive

One interesting tidbit from the inflation print is that airline prices increased 11% from February to March as people rushed to travel again after two years of COVID lockdowns. Airline prices could continue to increase into the prime summer season, so if you're looking to go somewhere, you should look into buying a ticket soon!

Why does this matter?

Airline carriers are being hurt by higher gas prices (gas is typically an airlines' second-biggest expense) and in turn, are cutting the number of flights and pushing more people on to each plane to save costs.

In normal times, this would spell trouble for airlines, but since people haven't traveled much over the past two years, consumers are not very price sensitive and are still willing to pay eye-popping prices to go on their summer vacations.

The airline carriers are confident that they will be able to cover the rising fuel costs and still make a profit, in turn driving up airline stocks over the past month.

JETS is up 13% over the past month on higher travel demand

Further Reading

WSJ: US Inflation Accelerate to 8.5% in March, Hitting Four-Decade High

WSJ: Airline Says Fliers are Flocking Back, Despite Higher Ticket Prices