Here's what drove the Market today and a key story on Ukraine asking Apple to stop sales in Russia that caught our eye.

Market Performance - February 25th, 2022

• The S&P 500 was up +2.1%

• The NASDAQ Composite was up +1.6%

• The DOW was up +2.4%

• The RUSSELL 2000 was up +2.1%

Today's Market Drivers

1. Russia - Ukraine War

Stocks continued their dramatic rebound as a Kremlin official said Russia was willing to meet with Ukrainian officials. However, no negotiations have been agreed upon, and few believe that Russia’s offer is in good faith.

While there is still hope for a peaceful resolution, intense warfare is still the reality on the ground. Today’s market gains are more of a reflection of the ongoing uncertainty of the war on the global economy.

Russia seeks to take the Ukrainian capital of Kyiv swiftly and remove its democratically elected government. Although Russia has a far stronger army, Ukraine has vowed to continue fighting, which could extend the resistance.

And the longer that combat continues, the more difficult it will be for Russia’s armed forces to occupy the country over the long run. It requires heavy logistics, costs, and energy to occupy a land of 40 million with active resistance.

Why does this matter?

Global stock markets will remain volatile until the situation is resolved, so don’t be surprised if the US Market is up or down a lot on Monday based on what happens this weekend.

2. What is SWIFT? And why are we talking about it concerning sanctions?

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is an international financial messaging system that allows financial institutions to communicate with one another to facilitate transactions.

For example, if you’ve ever sent an electronic wire, you’ve needed to input a SWIFT code to facilitate the transfer. And while the US and its European allies have upped sanctions on Friday to target Russian President Putin and members of his inner circle, they have avoided cutting off Russian access to SWIFT.

Europe has been reluctant to use SWIFT to stop Russian international transactions because they are major trade partners with Russia, importing wheat, oil, and gas. If Russia couldn’t access SWIFT, it’d effectively shut down trade.

Why does this matter?

Although SWIFT could be the most potent tool to hurt the Russian economy, it’s dual-edged. All of Europe would have to stop transacting with Russia, which supplies 30-40% of its energy in the middle of winter, and that could be economically devastating.

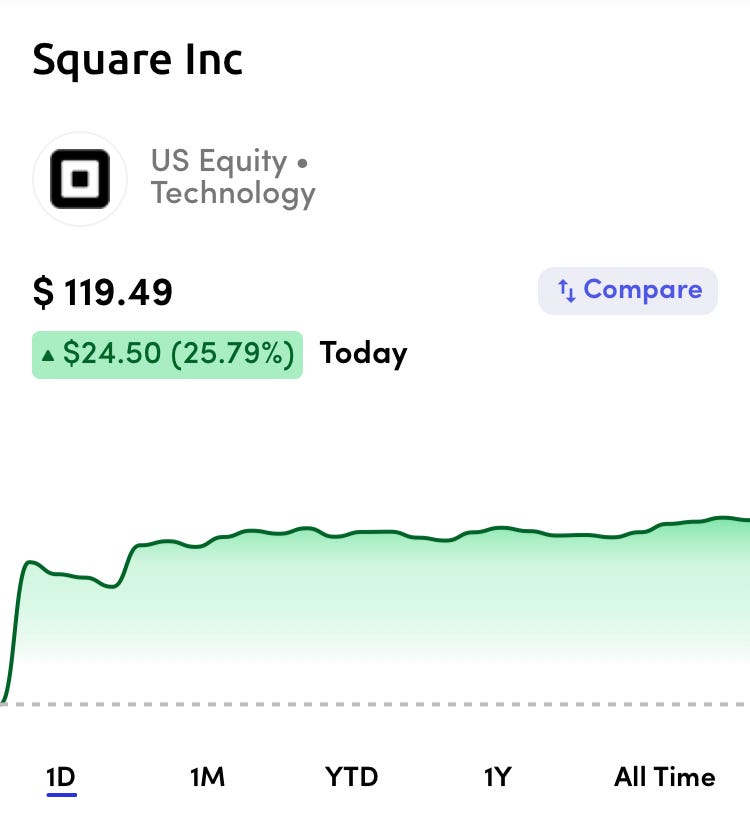

3. Block, the parent company to Fintech Square, Rallied 26% today

Block (formerly known as Square) was up 26% today on a good earnings report.

Block’s stock price has been hammered in 2022 over fears that its business would slow without stimulus checks and other pandemic benefits. But today’s results alleviated those concerns as user growth exceeded expectations, and profits per share beat estimates by 20%.

Why does this matter?

Block’s earnings beat is a good sign for the fintech theme, which has been suffering this year. Wall Street has worried that a changing interest rate environment would slow technology growth. But Square could signal that technology is doing better than Wall Street expected.

Here is one story we think is worth reading:

PC Mag: To Stop Invasion, Ukraine Asks Apple to Block iOS App Store In Russia

TL;DR:

Ukraine’s Vice Prime Minister has penned a request directly to Apple CEO Tim Cook to halt sales to Russia. Apple operates an online store and App Store in Russia, and if it accepts Ukriane’s request, it will hit Russia’s consumers directly.

But this would also mean that the global tech company could have lower sales from Russia for however long a halt to sales would be in place. Although Apple has signaled support for Ukraine, don’t expect the company to comply with moves that cut its profits.

Ok, that's it for today!

Alex & AT