Founder Chats: Listen to the short audio clip above to hear how Realize (Y Combinator Winter 22) is building an API that allows developers to embed investing everywhere.

Music by: Geoffrey Jerrell

April 20th, 2022

Market indexes were mixed today as tech and growth stocks slipped following Netflix’s disappointing quarterly earnings report. The Dow and Russell 2000, which have less exposure to tech companies, outperformed the S&P 500 and NASDAQ.

• The S&P 500 was slightly down by -0.06%

• The NASDAQ Composite fell by -1.22%

• The Dow gained +0.71%

• The Russell 2000 climbed +0.37%

The Market is dealing with the fallout from Netflix’s shocking earnings report that showed its subscriber base contracted in the first quarter of 2022. Wall Street fears that Netflix could be the first domino in tech stumbles that could shake the Market.

Netflix’s woes also dragged down the share prices of other streaming companies, such as Spotify and Disney.

Netflix signals that we could be at Peak Subscriber

Netflix, the streaming media giant, announced in its quarterly earnings that it lost 200,000 subscribers in the first three months of the year. This shock is the first time that the number of subscribers contracted in ten years, and Netflix expects to lose 2 million more subscribers this quarter.

Netflix erased more than a third of its value over the last 24 hours

Netflix had expected to increase subscribers by 2.5 million in Q1 2022. The stunning reversal has sent Netflix’s share price down more than 34%, erasing nearly $50 billion in market value overnight. The company has lost two-thirds of its value since peaking in November 2021 at over $300 billion in market capitalization.

Netflix executives cited four primary reasons for the shortfall:

Increasing competition from platforms like HBO Max and Disney+,

Pervasive account sharing, which Netflix estimates at 100 million households

The suspension of services in Russia, leading to 700,000 cancellation

High inflation is causing consumers to cut back on subscriptions

To reverse this trend, Netflix is considering an ad-supported plan and implementing tools to crack down on password sharing.

Why does this matter?

There may not be as many willing customers out there for digital services as previously believed.

Netflix’s shock could be a flash in the pan or a sign that Megacap tech companies have largely saturated their markets, and their growth is starting to slow. Last quarter, Facebook announced that its daily active user base shrunk for the first time.

As cracks emerge, they could signal that giant tech companies are beginning to mature. And with earnings season in full swing, Wall Street is on high alert over growth numbers for other tech service providers, such as Apple, Google, and Amazon.

If there is indeed a broader slow down across tech, it could have significant repercussions for FAANG (Facebook, Apple, Amazon, Netflix, and Google) heavy market indexes like the S&P 500 and the NASDAQ.

Tech companies make up 27% of the S&P 500 and 41.5% of the NASDAQ. Due to these heavy weightings, tech companies’ share performance has an outsized impact on these indexes.

So as Big Tech goes, the Market goes.

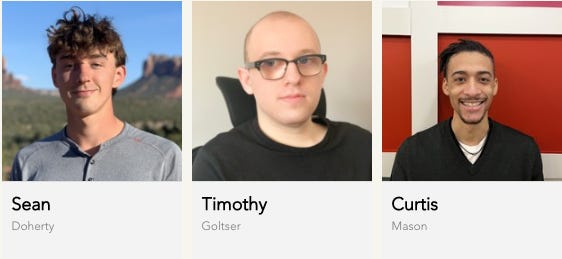

This week we spoke with with Sean Doherty, CEO of Realize! Check out our audio short above to hear about the solution that Realize is creating.

A short intro on Realize

Realize is building an application programming interface (API) for developers to embed trading into any application

Retail investors can invest out of their existing brokerage accounts from any investment service that uses Realize’s API

Currently, Realize supports integrations with Charles Schwab, Robinhood, TD Ameritrade, E*Trade, Alpaca, and Webull

Founders Sean, Curtis, and Tim came up with the idea as they were building their own investment app but realized other developers were probably encountering the same difficulties with integrating with a custodian.

How TAI integrates Realize

We’re super excited to partner with Realize as partners to bring their trading solution to you soon. So how does it work?

Essentially Realize works directly with brokers to allow you to securely connect your accounts to TAI to permit read and write access to your accounts. Read means pulling in your holdings and transactions, and write means allowing you to send trade orders to your broker.

Is this secure, and do you store my data?

Here’s the awesome part. Once you connect your accounts, Realize provides a session ID that allows you, and only you, to access your information and is randomly generated whenever you access TAI.

Any service we provide (such as portfolio analysis) that involves your account data is purely opt-in and neither we nor Realize stores your credentials and data.

We think this baseline is a big differentiator since we live in a world where digital brokerage companies are mining data to sell to market makers. That ain’t cool. And as fellow individual investors, we believe that any data sharing should be private by default.

Does it work?

Absolutely. And very reliable. Realize and TAI are collectively spending hundreds of hours on quality and assurance, making sure that the trading experience is seamless and secure before live release to the public.

Trading from your existing accounts is coming in our next release in May.

What does Realize enable developers like TAI to do?

When you can access your different accounts from a single place, it can greatly increase your clarity of the totality of your portfolio. And from a unified portfolio, you can discover ways to improve it and, through TAI, act on insights.

We’re working on cool tools that we hope can help you invest even better. And Realize allows us to bring them to you faster and in more meaningful ways.

So stay tuned.