Founder Chat: This week we chat to Conor Colwell, co-founder of Liquidstar, which is building the modular, decentralized utility stations for the 1 billion people without access to utilities.

May 4th, 2022:

The Market had its best days since May 2020 on news that the Fed does not plan to accelerate rate hikes.

• The S&P 500 was climbed by +2.99%

• The NASDAQ Composite surged up by +3.19%

• The Dow Jones Industrial Average was up by +2.81%

• The Russell 2000 paced up +2.69%

Federal Reserve raises rates by 0.50% and pours water on higher hikes than planned

Ahead of today's Federal Reserve meeting, Wall Street was anxious that the Fed would announce that it would increase interest rates by 0.75% during the next meeting in June. Fed Chairman Jerome Powell soothed these worries as he confirmed that 0.75% rate hikes were off the table.

Today's 0.5% rate hike is the highest since 2000. But Wall Street, which has been increasingly worried about a more aggressive Fed, cheered on the softer tone and used it as a rallying point to send stocks higher.

Why does this matter?

Following one of the Market's worst months since the start of the Pandemic, May is showing signs of a rally on the back of more moderate interest rate hikes. Wall Street had priced in accelerating rate hikes, but today's message from the Fed is keeping the Market's worst fears in check.

Treasury Secretary Janet Yellen also helped soothe nervous investors by telegraphing that the US economy could see a "softer landing" as the Federal Reserve tightens credit. In the US, the economy still shows resilience, providing investors with the hope that the US economy can absorb rising interest rates without entering a recession.

The European Union (EU) debates a Russian Energy Import Ban

Seeming farfetched only a few weeks ago, the EU is circulating a draft prohibition on Russian oil & gas imports.

The EU has already adopted a phased-in ban on Russian coal, but a complete severing of the oil & gas trade with Russia has seemed implausible due to Germany's heavy dependence. However, the ban appears much more likely now, causing energy commodity prices to rise drastically.

Natural Gas Prices are up more than double this year

Why does this matter?

The EU is looking to cut off funding for Russia's invasion of Ukraine. Since the start of the war, the EU has sent nearly $1 billion per day to Russia in exchange for energy imports.

While Russia has started cutting oil output and shifting exports to developing nations, such as India and China, it will see less total trade if the ban passes. But a complete ban on Russian energy will be difficult for the EU's economy to absorb and could lead to recessions across the country.

As Europe scrambles to source supplies across the globe, energy prices will likely rise and stay elevated, making inflation more difficult to dispel globally.

Further reading:

AXIOS: Stocks breathe a sigh of relief after Fed hike

REUTERS: EU prepares Russian oil sanctions, warns against rouble gas payments

About Liquidstar:

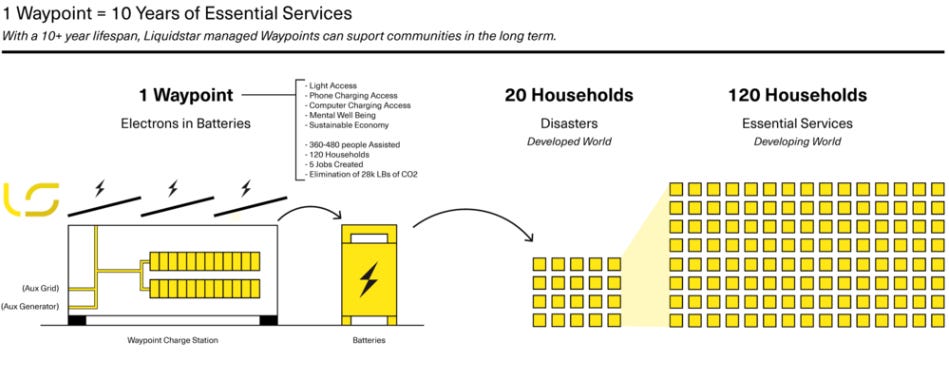

About 1 billion people in rural communities globally lack access to essential utilities like electricity, clean water, and the internet. Liquidstar looks to bring them these necessities via “Waypoints,” repurposed shipping containers equipped with sustainable utility technology.

Key facts:

Liquidstar has two pilots in Djibouti and Kenya for their distributed utility solution, with rechargeable batteries that power eMobility.

The company is partnering with Starlink to turn these waypoints into internet hubs where users can charge their devices while working.

Excess energy is recycled into a blockchain mining station that rewards users in the form of rebates.

Liquidstart’s larger goal is to help tackle the United Nations Sustainable Development Goal 7, providing essential utilities to 100 Million people.

The Core Team is working with governments and NGOs globally and has spoken a the Davos forum.